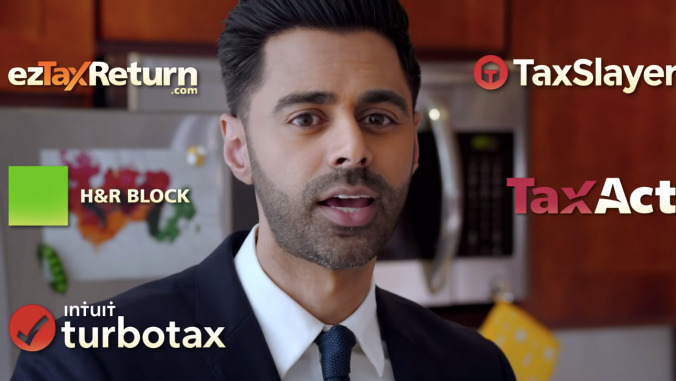

Hasan Minhaj launches TurboTaxSucksAss.com, a real website to make filing taxes less awful

Aux Features Hasan Minhaj

Perhaps the most egregious of all the misleading tax prep websites is TurboTax, which has a documented history of advertising “free” filing products that then hamstring unsuspecting customers into ponying up extra cash for bells and whistles they don’t actual need to submit their tax returns.

But, despite them having been called out, there’s very little anyone seems to be able to do about TurboTax’s misleading greed goblins. Hasan Minhaj succinctly laid out the infuriating truth during a recent episode of Netflix’s Patriot Act, which also included a pretty nifty announcement: The creation of TurboTaxSucksAss.com, a website that delivers on the name.

Watch Minhaj break it down below:

Minhaj and company have generously taken the time to sort through all the bullshit not just on TurboTax, but also similar competitors like H&R Block and TaxSlayer, to provide everyone with simple, direct links to the truly free services these places still offer. It won’t stop you from owing a government that appears hellbent on trying to kill us all, but at least it might help you avoid shelling out unnecessary cash to the carrion capitalists running these companies.

[via Vulture]

Send Great Job, Internet tips to [email protected]

46 Comments

It took all of one time of Turbotax trying to charge me for having a “nontraditional filing” because I had a student loan to make me swear never to use their bullshit product again.

That’s weird, I filed with my student loan interest for years with them and never got charged.

I use TaxAct, which does the same thing. Every year it gets more expensive and more things that used to be included in the free tier are locked behind one of the premium tiers. Though it’s never truly been free for those of us who live in states with an income tax.

State taxes have been free in TurboTax for a couple years now. Before that I just didn’t send in my state tax forms because I was always within the + or – $1 area and figured they wouldn’t come after me for that.

For some reason, I’ve always owed money to my state no matter my employer. I get more back from the fed than I owe to the state, so it’s not a huge deal, but it’s weird.

That is weird, you’d think that at least one of the employers would get it right so maybe the state just doesn’t like you?

Well, I have assassinated six lieutenant governors, so it definitely could be the latter.

This happened to me too! I will not be using them next year. They made me pay them $98.00 to do my state and federal taxes.

Wow, I’d never heard of that. Is that something they do with the online version? I opt to pay each year for the CDROM version Costco sells, that bundles state and federal. The only fee they charge me is a service fee to electronically file, which they deduct from my refund. It’s not too much, and frankly worth it to get my refund in a few days, rather than six weeks by check.

It KINDA sucks but I’ve known a number of people over the years who paid accountants to fill out their very simple tax forms, once I tell them ‘Try Turbotax’ they never go back to paying $250+ to get their taxes done. You really just have to keep clicking that you want the free version instead of clicking that you want to upgrade to any of the paid versions.That being said, fuck Quicken for spending so much money over the past 20 or so years to make sure we still actually have to fill out taxes rather than just having everything done automatically and only having to enter exceptions.

Yep, it boggles my mind how many people still use accountants for simple personal taxes. If you don’t own a business or large amounts of property there is no real reason to hire one.

My taxes are relatively simple, but paying my accountant $330 a year nets me an extra $3-$5k that I’d miss if I did it all myself. It’s all about those loopholes and small text baby!

Ditto here. We did our own taxes for several years using various sites (TurboTax, TaxAct, etc.) and while the process was generally fine, we finally switched to using a recommended local accounting firm and not only has the process been totally painless (they do all the work), they routinely do a way better job than we were doing. Honestly, for us, it’s worth the money not to have to deal with the hassle.

What loopholes?

This has also been my experience. Our taxes aren’t too complicated, but we both work from home and have a child. We definitely save more than we pay.

Counterpoint: every time I’ve hired an accountant, they’ve always found deductions and programs that earned be back 10x their fees or more that I otherwise might not have known about. Worth the $200 for me.

Out of curiosity. Have you tried one year to just run your taxed through TurboTax as well and see what you get. They don’t charge you until you hit the button to file. You may be surprised to see the software gets you all the same deductions and programs to save you money

I have, but then my accountant comes back with stuff like “hey you can deduct up to $X per meeting you have in your home,” using Donald Trump like shenanigans where I pay myself a deductible consulting fee. Those end up putting more money in my pocket. And I don’t have to spend more than a 20-minute phone call doing the paperwork. My father, who’s a college professor, also started getting a big pile of cash back after using an accountant. I’m typically a DIY guy. If I could do my own dental work, I would. But paying my accountant is something I do GLADLY because it always pays for itself. My time and the opportunity cost of spending an hour or two working on my own taxes is one I’d rather outsource.

using Donald Trump like shenanigansWell that sounds completely on the level and not at all dubious when you put it that way

People always like to say “my accountant saved me five thousand dollars!” but can never actually explain how. I don’t have a business, rental property, a home office or any of the usual dubious shit people use for stuff like this.

When I did some contracting I was tempted to hire an accountant. I ended up figuring it out because I’m cheap, but approaching the world of quarterly estimated taxes, self employment taxes, and expanded types of deductions (plus doing it at the federal and state levels) was intimidating. The tax software I looked at seemed to have an approach of plug in the numbers and trust us, and I wasn’t OK with that. Maybe I should have been OK, but the number of online complaints I read about them made me skeptical.

After reading through all of the IRS documentation I figured it all out, but it wasn’t simple or quick, and I didn’t even have a complicated income stream.

Seriously! My filings are pretty simple but even when I owned stocks and was deducting college loan interest it was simple and free.Even before I used Turbotax I would use the telefile which was stupidly simple too, though I didn’t have loans or stocks then so I’m not sure if you could do anything beyond the EZ form on it.

Yes, there is a special kind of evil in the lobbying done by these companies to block easy tax filing and make the tax code as complicated as it is. Grover Norquist, who fronts for these guys, has been crystal clear that he likes insanely complicated tax returns because it increases the number of people who hate the IRS.

Conservatives posing as libertarians want most Americans to spend more time filing taxes than they should. It makes it much easier for them to market tax cuts for the rich as “simplification” and it helps them push to massive cuts in compliance and audits for the rich and big corporations. And they want the limited tax benefits for everyday Americans, like the child tax credit, to be as imposing and difficult to complete as possible in order to create barriers for using them as well as opportunities to punish people for small mistakes.

And the worst part is that hardly anyone knows about it. I tell people about how much money Quicken spent in the early ‘00s to stop easy filing and they have no clue.Grover Norquist is one of the greatest villains of modern American history.

I used to do taxes for HR Block. It disturbed me the number of people who came in who had simple tax returns (regular income and kids). It cost them $300 to get it done in the office when if they just did it online, it costs them $0 (paying attention to their trickery of course).

I know of at least a couple people my age who did it because their parents did it and they just kept going, took years to convince them to use Turbotax. Even if you get the $30 version that’s friggen 10% of hiring someone and all you do is type numbers in boxes.

Turbotax sucks and the fact that they have lobbyist in Washington intentionally keeping tax filing complicated is bullshit. That being said, I’d rather by my yearly $75 dollar tithe to TurboTax then several hundred dollars to an accountant who is basically just going to use his internal equivalent of turbotax anyways. Yes you can do to IRS and fill in the forms yourself but turbotax does offer help with what to file and possible other savings. Also its a big help when figuring out how to setup things like payment plans if you owe a lot. Our system should be as easy as it is in other countries when they send you a post card that says “You made this much, you paid this much tax, you owe us(or are getting a refund) for this much)“ But sadly that will never happen because the rich and powerful like a complicated tax law because it leaves loop holes for them to not have to pay and ensures the mass have too.

I am an accountant and absolutely agree. I worked for HR block years ago. To be a tax accountant there you had had to take this 3 month course. Accounting firms used HR Blocks classes to learn how to do taxes as anyone could take the course. They would not even hire CPA but have ghosts do the tax stuff for them.

I’ve used the basic, paid web version ($70-ish) for about ten years, and think it’s probably one of the best software experiences in any category. Remembers all your shit from last year, makes adjustments based on life changes, and support is fast. It’s clear their design team put a ton of thought into making everything super obvious and easy to interact with for a broad spectrum of users.

Yes, they frequently try to persuade you into upgrading for unnecessary features, and it is deeply shitty that their marketing attempts to bait-and-switch under-$60,000 filers (they do offer actually free filing, which can be found by Googling). This practice deserves a spectacular John Oliver rant.

Software good, company bad.

I’ve used CreditKarma’s free service the past couple of years and it’s completely painless.

For years I’d use free H&R Block online or Turbotax to do my federal, then file my state taxes through my state’s website to avoid the fees they’d charge for state returns. When I switched to CreditKarma, the numbers of what I owed came out the same, the only difference I found was I could file state taxes for free. Maryland’s iFile is easy to use (especially for a state run website), but pressing a button on CreditKarma is even easier.

I’ve yet to watch the video, but I’m somewhat baffled by the premise. I buy Turbotax every year when it comes out… it’s what, like, 20 bucks? It pulls in all my T4s and whatnot. It finds the best spousal splits for claiming stuff. The online chat help / forums are great for any necessary clarifications. I’m done in a couple of hours, Netfile is simple, we always wind up with a refund, and it turns up in under a week. Seems like a reasonable value for 20 bucks. I mean sure, it offers you all this extra junk like consultations and audit insurance and all that associated bullshit, but y’know, you can just click “no”, right? It’s not like it gets you 95% of the way through the process and then hits you with an extra hidden required fee. Is it?

The fact that you have to fill that all out at all is the fault of companies like that – the IRS should send out what they think we all owe, and then let us enter any exceptions they missed, but that would eliminate the need for products like this, so they lobby to keep tax law as complicated an confusing as possible. They’re an evil industry.

I mean… I guess? I just look at it like this: I have to do taxes anyway. I could go and get all the forms and stuff and gather my receipts and all that whatnot and do it by hand and send it in, sure. Or I could drop the price of a takeout meal on a piece of software, and wrap the whole process in an afternoon. I’m paying for the convenience. I don’t see how that makes them evil. Maybe it’s a Canadian thing.

The evil part is that they keep taxes complicated so that people need their product. They lobby to keep the IRS from doing things that would make the process simpler. So no, you don’t have to do it anyways – most of tax prep involves forms that the government sends, they could easily do those calculations themselves, but then turbotax wouldn’t have a product.

Um, okay? As just a regular person, I’m not exactly sure what you’re proposing as an alternative.

the alternative being proposed is in the comment you replied to: the government is perfectly capable of sending you a tax bill. tax prep companies lobby to keep the tax code archaic because otherwise their business model is eliminated. there is no reason for the taxpayer to have to calculate their own taxes, it’s completely absurd.

Yeah, I read that. As I am not King Of Taxes, I can’t make that happen so I’ll just keep doing what I am doing now.

Logically, most of tax prep should be done by the IRS – they’re the ones generating most of the forms we use, and they’re the ones who know the rules the best. Then, people could just add in their exemptions and deductions. This has been proposed before, and it’s been blocked due to lobbying by companies who depend on people being confused by their taxes. Similarly, those companies actively work to keep rules about exemptions, etc, as confusing as possible. They’re creating helplessness just so that they can sell a product to fix the problem they lobbied to create. They’re not as evil as, say, health insurance companies, but that’s a high bar. They’re still pretty awful.

The fact that you have to fill that all out at all is the fault of companies like that – the IRS should send out what they think we all owe, and then let us enter any exceptions they missed, but that would eliminate the need for products like this, so they lobby to keep tax law as complicated an confusing as possible. They’re an evil industry.

Apparently TurboTax has a “free” version which almost always routes you towards a paid version costing $60-120. Meanwhile, they have a legtimately free version (which they lobbied the government to make so the IRS wouldn’t develop their own free alternative) which is nearly impossible to find.Like you, I’m Canadian, and I’m content with my paid online choice (Ufile) at $20 or whatever, but I also had no difficulty in getting it free when I was low income.

My issue with TurboTax is less the aggressive upselling (I have no problem clicking “no, leave me alone” a few times) than the fact that they start charging for basically anything beyond a straight-forward federal return. State return? Costs extra. Do any freelance work and have a form 1099-MISC? Costs extra.

I find it’s cheaper for me to pay up front for H&R block tax software every year. About $25/year if I buy it from Amazon early enough. Which I think is the equivalent of “It’ll go easier if you shut up, bend over, and take it like an American taxpayer.”They also try to charge me for state filing every year, but I know that my state has free online tax filing. I just have to copy everything from the PDF of the paper forms.

You all keep saying “yeah, turbotax is not exactly great, but it’s still cheaper than hiring an accountant” instead of considering that the vast majority of people in other developed countries file their taxes for free (or have them filed by the government) without paying any company or hiring any accountants and maybe that should be your goal. I mean, aim a bit higher, people.

I did my taxes this year on TaxAct, and their $55 package ended up costing me $171 when they attached a bunch of fees at the very end (after I’d already entered all my data and sat through two hours of checking boxes and answering questions) that I couldn’t decline – it was either pay up or start over with someone else. I don’t know what I’ll use next year, but it will not be TaxAct. I’ve already set a reminder for myself to use anything else – I plan to carry that grudge to my grave.

Winners don’t pay taxes.